Maharashtra Cabinet Gives Nod To OPS Benefit For 26,000 Employees Who Joined Service After Nov 2005

Maharashtra Cabinet Gives Nod To OPS Benefit For 26,000 Employees Who Joined Service After Nov 2005

Current Affairs Daily Articles & Editorials

La Excellence IAS Academy | January 5, 2024 | Governance

Syllabus: GS-II

Subject: Governance

Topic: Welfare schemes for vulnerable sections.

Issue: Pension Scheme.

Context: Maharashtra cabinet approves one-time option for state govt employees joining after Nov 2005 to opt for Old Pension Scheme (OPS).

Synopsis:

- Move addresses a long-standing demand but has a limited scope, benefiting a specific group of employees.

- Decision follows protests by employees demanding restoration of OPS.

- Benefits 26,000 employees selected before Nov 2005 but receiving joining letters later.

- OPS discontinued in 2005, offers monthly pension without employee contributions.

- Employees have six months to choose OPS or stick with New Pension Scheme, with a two-month document submission deadline.

Background:

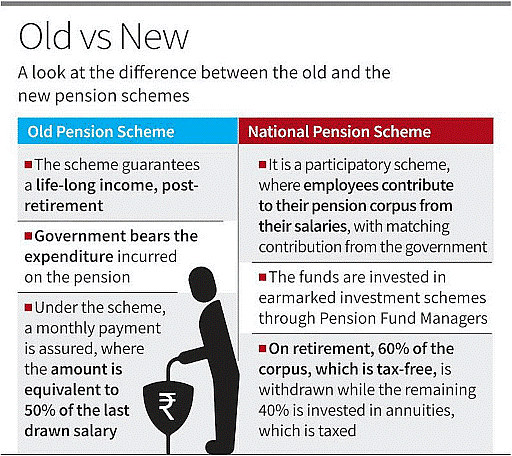

Old Pension Scheme (OPS):

- OPS assured government employees a pension of 50% of their last drawn salary.

- Described as a ‘Defined Benefit Scheme,’ it provided a defined and secure retirement benefit.

- Discontinued by the Central government in 2003.

Concerns with OPS:

- Unfunded pension liability led to no specific corpus for continuous payouts.

- ‘Pay-as-you-go’ scheme caused inter-generational equity issues, burdening the present generation with the rising pensioner costs.

- Lack of a clear plan for future funding prompted the discontinuation of OPS in 2003.

What is New Pension Scheme (NPS)?

- NPS, introduced in April 2004, replaced OPS by the Central government.

- Open to employees in public, private, and unorganized sectors, excluding the armed forces.

- Administered by the Pension Fund Regulatory and Development Authority (PFRDA).

- Eligibility: Indian citizens aged 18-60, including NRIs.

- Minimum annual contribution: Rs. 6,000; failure to contribute results in account freezing.

Conclusion: OPS, with its defined benefit of 50% last drawn salary, provided assurance to government employees but faced challenges like unfunded pension liability and inter-generational equity issues, leading to its discontinuation in 2003.

Source: The Hindu

Leave a Reply

You must be logged in to post a comment.